You've been making installations throughout the improvement, but when the last thing on your punch The original source listing has been resolved, it's time to pay the continuing to be percentage to your professional. Generally, our Sweeten service providers claim that the building and construction duration for a bathroom job will average concerning two to three weeks. On the whole, expect the restoration to take between 6 weeks to three months for the planning, implementation, as well as concluding loose ends.

PMI is a sort of insurance that kitchen remodel highland park safeguards your lending institution if you quit making payments on your lending. Despite the fact that you're the one paying for it, PMI uses no benefits. Consequently, lots of people want to terminate PMI asap.

Which bank is best for renovation loan?

Best Renovation Loans in Singapore (2020)Citibank Quick Cash Loan. SingSaver's Exclusive OfferFeatured. 3.99%

DBS Renovation Loan. 3.88% Annual Interest Rate.

OCBC Renovation Loan. 4.18%

CIMB Renovation-i Financing. 4.33%

Standard Chartered CashOne Personal Loan. Popular.

HSBC Personal Loan. Popular.

Acquiring fixer-upper residences is presently a prominent financial investment in the real estate market, particularly since lower-priced residences enhance real estate confidence in home purchasers. On the one hand, it is a wonderful method to purchase a house below market value and market it for greater than you paid. On the various other hand, it frequently appears to be much more work than people prepare for, and also often the end product doesn't wind up being worth as much time, effort, and cash as individuals took into it.

Most remodeling tasks have a 50% to 85% roi. The leading remodeling projects that return more than 85% of your financial investment are home siding replacement, garage door substitute, a brand-new restroom enhancement, and also changing home windows and roof. To optimize resale value, stay clear of investing greater than 20 percent of your house's worth on the complete improvement prices.

Obtaining Home Improvement Estimates.

Which bank has the easiest personal loan approval?

The easiest banks to get a personal loan from are USAA and Wells Fargo. USAA does not disclose a minimum credit score requirement, but their website indicates that they consider people with scores below the fair credit range (below 640).

- Keep in mind that if you terminate the refinance, you will more than likely have to pay the assessment cost.

- When the home builder finishes the job, and also the home gets its Certification of Occupancy, your new lending repays the building and construction loan.

- There are 2 various other approaches for appraisers to value building-- the replacement expense and the revenue method.

- This also applies if you make use of a 203 re-finance to include some residence renovations when you re-finance your building.

- If the low evaluation is the home builder's fault-- state, the quality of building or products were not as explained in the car loan application records, you may be able to sue your contractor.

A down payment is the first settlement you make towards the home and also it schedules when you close on your mortgage. Lenders typically determine your deposit as a percent of the total quantity you obtain. Homes up for sale as well as looking for architectural repair can present funding concerns because of those repair services, unfortunately. Oftentimes, private lending institutions such as financial institutions won't approve standard home loan on houses in demand of considerable repair work as a result of problems with their evaluated values. Nonetheless, a government backed rehab home mortgage for eligible owner-occupants is offered for houses needing structural repair.

How do I qualify for an FHA home improvement loan?

FHA loans were created to allow people to buy a home with a smaller down payment. The minimum amount for a down payment is 3.5 percent of the total loan amount that includes both the cost of the house and renovations. A credit score of at least 580 is needed to be approved for the loan at the 3.5 percent down payment.

How do you approach a home renovation?

10 Tips to Renovate your House Beautifully yet Economically 1. Divide and Conquer. As mentioned earlier effective planning is the key to effective renovation.

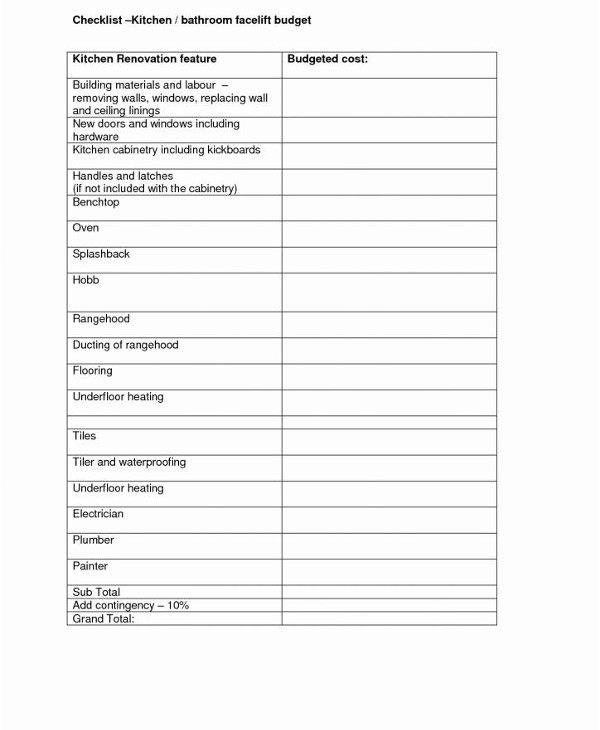

2. Budgeting.

3. Research.

4. Doors Create the First Impression.

5. Paint Affects Lighting.

6. Small Rooms don't have to Look Small.

7. Kitchens and Storage.

8. Light Comes through the Windows.

More items•

Boosting your home loan for home improvements may add worth to your property but making use of a more advancement to repay financial obligations is rarely a great idea. You can spread your settlement over a long-term and your rate of interest need to be less than a personal lending. But individual lendings are a lot much more available than HELOCs or home equity finances for some. Because of these distinctions, a HELOC might be a better option than a residence equity finance if you have a few more economical or longer-term jobs that you'll need to fund on a recurring basis. Yet, passion is just due on your impressive HELOC balance, which can be a lot less than the full pre-approved quantity.